The Unique Landscape of SMB vs Enterprise SaaS

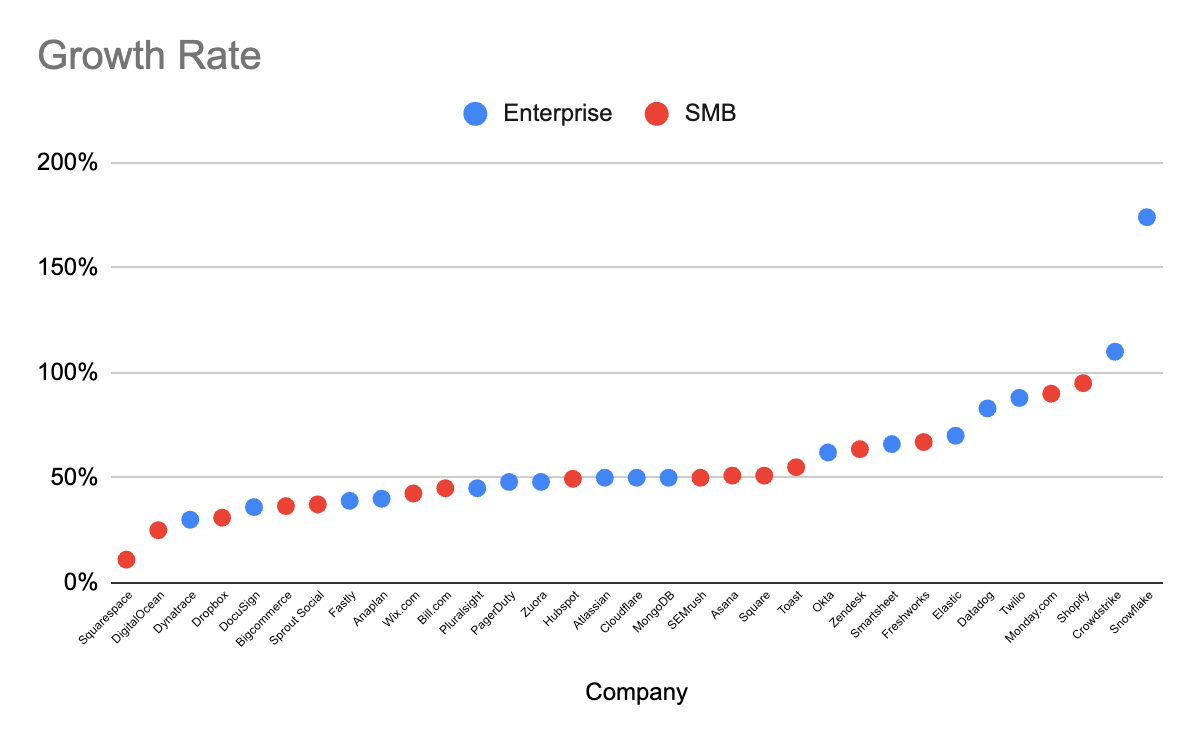

Comparing SMB and Enterprise SAAS companies at IPO

Let's take a closer look at some of the key differentiation in the metrics of these two types of companies at IPOs.

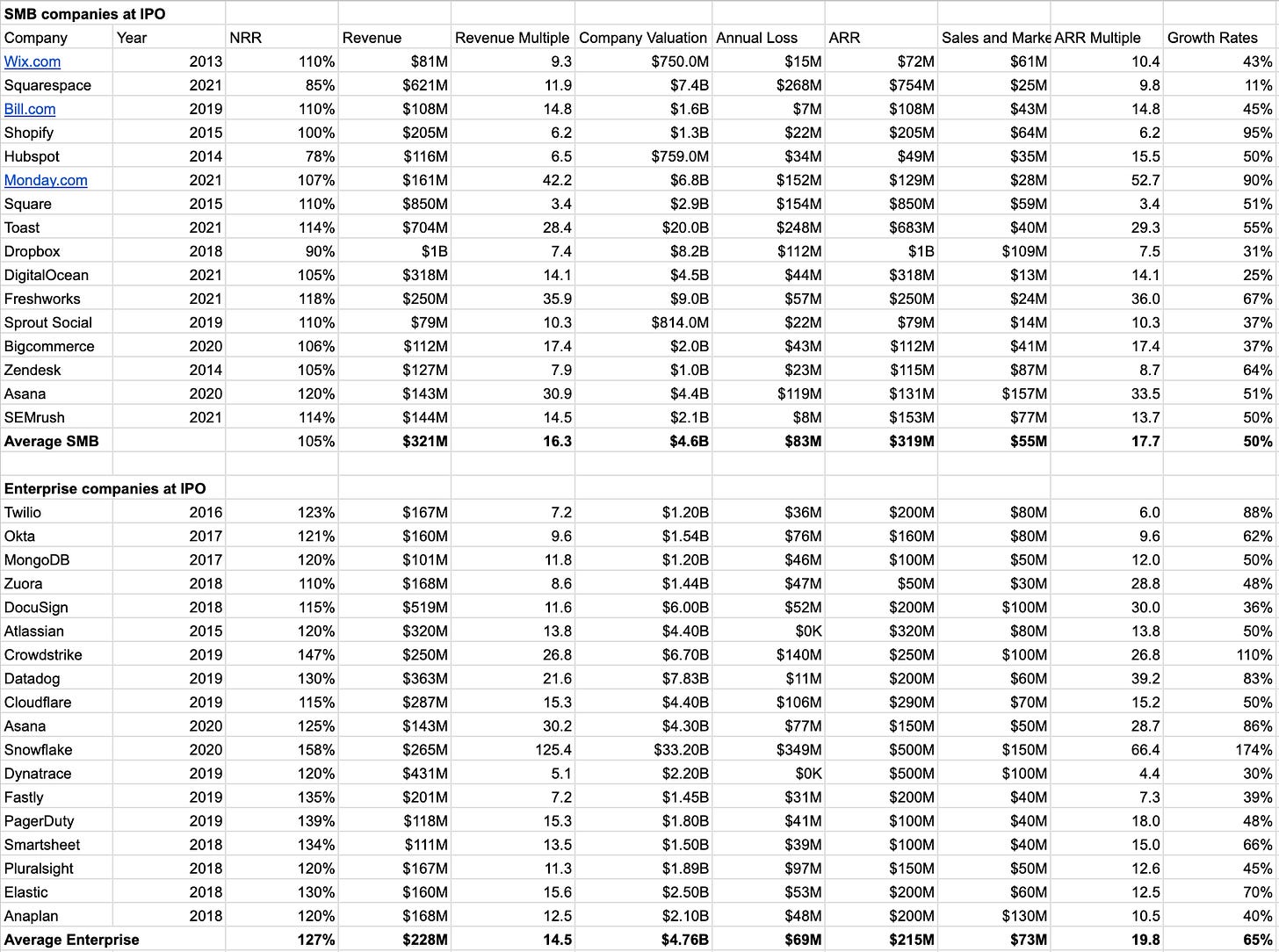

NRR

A notable difference is the net revenue retention (NRR) rate, which measures the ability of a company to retain and upsell existing customers. SMB companies have an average NRR of 105%, while Enterprise companies have an average NRR of 127%. This is likely due to the fact that Enterprise companies have a smaller customer base with larger contract values, which makes it easier to achieve higher NRR rates. SMBs focused SAAS companies tend to acquire customers more cheaply but also churn them as easily.

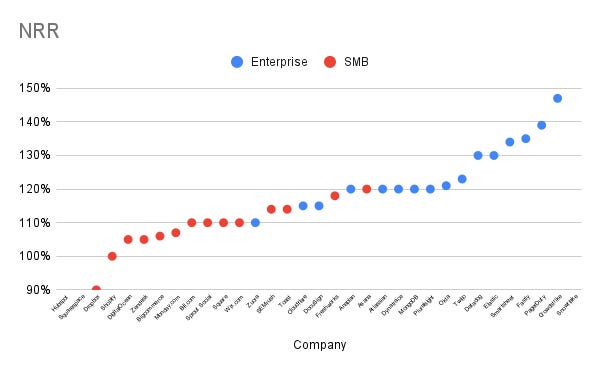

S&M Expenses

Sales and marketing expenses as a percentage of revenue is another key differentiator between SMB and Enterprise companies. SMB companies have an average spend of $55M, which represents 17.7% of their revenue, while Enterprise companies have an average spend of $73M, which represents 19.8% of their revenue. This indicates that Enterprise companies spend more on sales and marketing than SMB companies, likely due to the longer sales cycles and larger deal sizes associated with Enterprise sales.

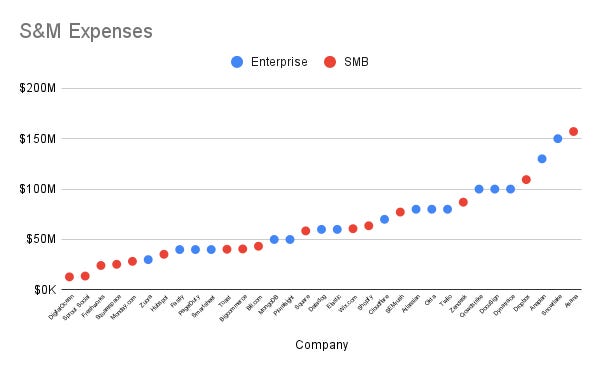

Growth Rates

Finally, it's worth noting the growth rates of these companies. SMB companies have an average growth rate of 50%, while Enterprise companies have an average growth rate of 65%. This is likely due to the fact that Enterprise companies have larger deal sizes and longer sales cycles, which means that they can achieve higher growth rates with fewer deals. Although this might also be because of a few outliers (Snowflake)

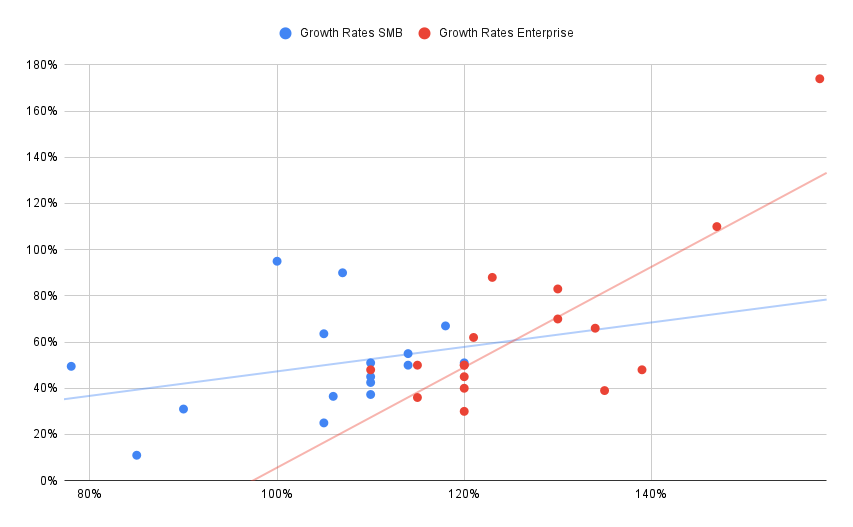

Growth Rates vs NRR

We see an interesting pattern here. For Enterprise focused companies Growth rates are directly proportional to their NRR but the correlation is quite weak for SMB focused companies.

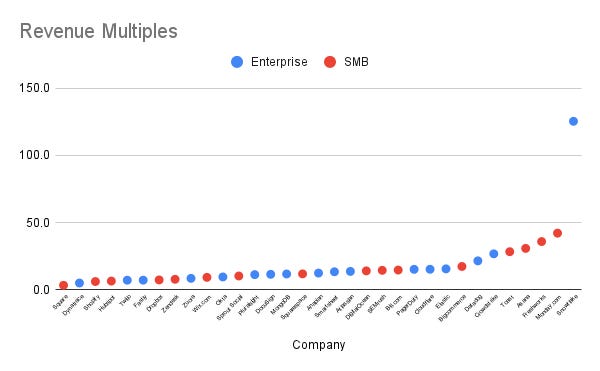

Revenue Multiples

Investors tend to like Enterprise and SMB companies equally with similar Revenue multiples (although Snowflake does skew the numbers towards enterprise)

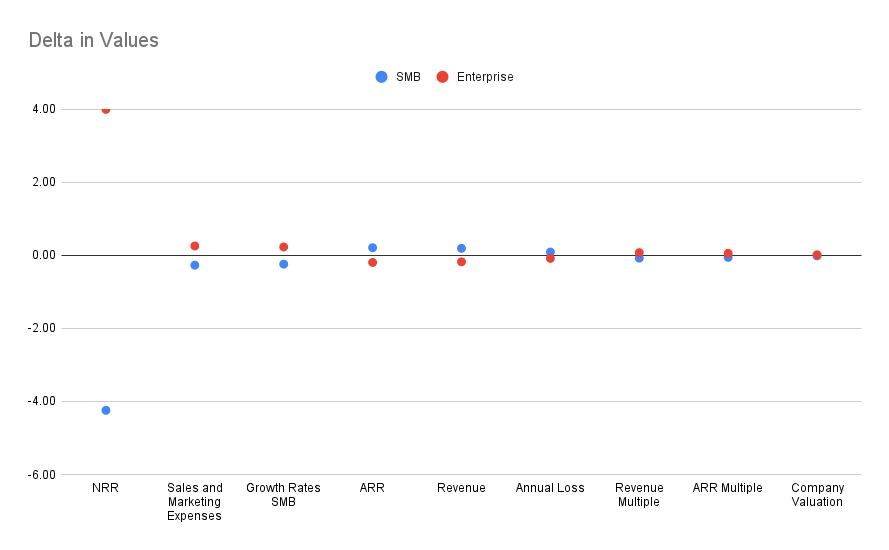

So what is really different?

If we look at the normalised differences (subtract the mean divide by the standard deviation), we see that the largest delta is in NRR and everything else is a distant second. The sales and marketing expenses are the next in consideration. What is least effected by who you sell to? It’s the companies valuation, so if you sell to SMBs or Enterprise as a founder and investor you are going to make the same amount of money.

Thanks to Dishank for helping prepare this.